Schema Validation Failed in GSTR 9: Causes & Solutions

- 10 Sep 25

- 7 mins

Schema Validation Failed in GSTR 9: Causes & Solutions

- GSTR-9 annual return filing requires accurate schema validation to ensure compliance with GSTN-prescribed formats.

- Common causes of schema validation failure in GSTR-9 include invalid GSTIN, incorrect date formats, wrong HSN codes, and data mismatches.

- Businesses must correct errors like discrepancies in GSTR-9 tables and exceeding character limits to pass schema validation.

- Using updated GST compliance software helps taxpayers avoid schema validation errors and file returns smoothly.

- Timely rectification of GSTR-9 schema validation errors ensures accurate GST filing and avoids late fees or penalties.

Filing the GSTR-9 annual return is a critical compliance requirement for businesses registered under the Goods and Services Tax (GST) regime in India. However, many taxpayers encounter a common hurdle during this process, the "Schema Validation Failed" error.

This error message details discrepancies between the data submitted and the prescribed format outlined by the GST Network (GSTN). Understanding the reasons behind this error and implementing effective solutions is essential to ensure accurate and timely filing.

So, keep reading to know everything about schema validation failure in GSTR-9.

What Is GSTR-9?

Registered taxpayers need to comply with the filing process of GSTR-9 returns annually. It includes details pertaining to inward and outward supplies (purchases and sales) during a financial year. This form further entails details of tax values related to CGST, SGST, IGST (Central/ State/ Integrated Goods and Services Tax)Cess, and HSN codes.

In other words, this form is the consolidated form for quarterly or monthly returns such as GSTR-1, GSTR-3B, GSTR-2A and GSTR-2B. GSTR-9 effectively helps reconcile data from other returns forms.

Last Date to File GSTR-9

The due date to file GSTR-9 returns is 31st December of the following year. For instance, the deadline to file GSTR-9 returns for the financial year 2024-25 is 31st December 2025.

Penalty and Late Fees for Late GSTR-9 Filing

Here is the late fee for delayed GSTR-9 filing:

| Turnover Threshold | Late Fee Per Day | Maximum Late Fee |

| Up to ₹5 crore | ₹50 (₹25 each under CGST and SGST Act) | 0.04% of turnover in state/UT (0.02% each under CGST and SGST Act) |

| Exceeding ₹5 crore and not exceeding ₹20 crore | ₹100 (₹50 each under CGST and SGST Act) | 0.04% of turnover in state/UT (0.02% each under CGST and SGST Act) |

| Exceeding ₹20 crore | ₹200 (₹100 each under CGST and SGST Act) | 0.50% of turnover in state/UT (0.25% each under CGST and SGST Act) |

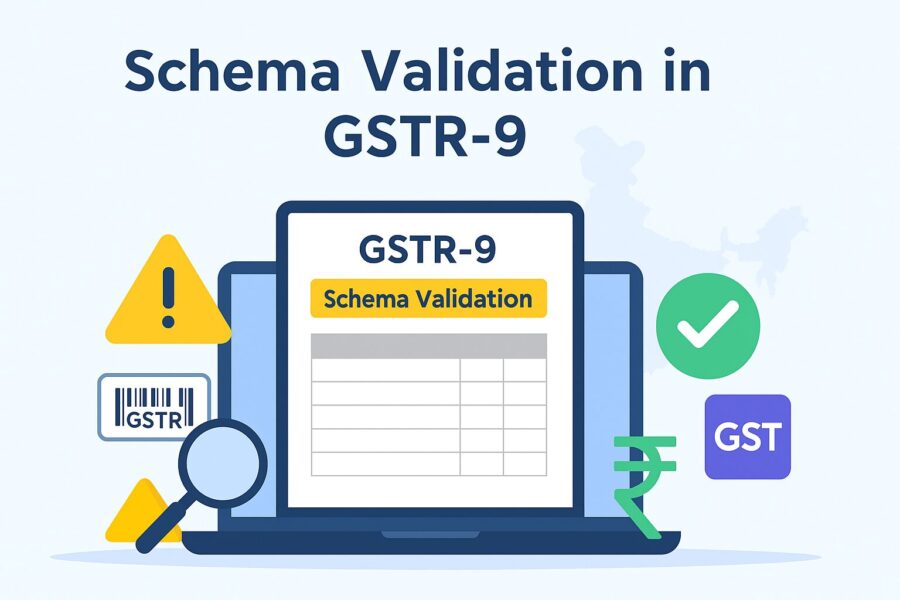

Schema Validation in GSTR-9

Schema validation in GSTR-9 refers to the process of verifying the structure and format of the data entered in the return against the predefined schema provided by the GSTN. This validation ensures that the data conforms to the required standards, including correct field formats, mandatory fields, and logical consistency. If the data fails to meet these criteria, the system generates a schema validation error, preventing the submission of the return.

You can use schema validation to check if the entered data on the GST portal is correct and follows the format mentioned on the portal. In case of discrepancies, you will find a schema validation error code. You need to rectify the details to proceed with the GSTR-9 application.

Reasons for Schema Validation Failure in GSTR-9

Here are the reasons behind schema validation failure to consider:

- Schema validation error can inspire the wrongful or non-standard format of a GSTIN. Every GSTIN should conform to the basic 15 characters.

- The format of dates is another item; dates must be filled in the prescribed format (dd/mm/yyyy), as alternative formats may face rejection through the validation mechanism.

- Invalid HSN Codes must be supplemented by the latest and correct HSN codes. Using older or incorrect HSN codes leads to errors. Inconsistent data across sections.

- Discrepancies across different sections of the returns, such as mismatched figures of Table 6 and Table 8 would lead to validation errors.

- Exceeding the allowed length for fields entering values that exceed the allowed characters or digits in fields leads to a schema validation failure.

Resolutions for Schema Validation Failure in GSTR-9

You can resolve schema validation failure in the following ways:

- Once you get the details of a schema validation failure error message, correct the identified erroneous data and scan for any special characters to get rid of the glitches.

- A quick fix via compliance software upgrade will also take care of the errors, allowing you to proceed with the GSTR-9 filing.

- Make sure all the data entered, such as GSTINs, dates, HSN codes, and numerical values, are in the prescribed format and are consistent with each other across all sections of the return.

- If these errors are still unexplained, take up with the GST helpdesk or seek the assistance of a tax professional in pinpointing and resolving the complex errors.

Conclusion

If schema validation failed in GSTR-9, you need to rectify the errors to proceed further. Ensure you identify the errors and rectify them within the stipulated deadline. This helps you file GSTR-9 within the due date, thereby avoiding paying late fees for delayed payment.

Notably, the process for e-way bill error rectification is different from any GST return rectification. You need to follow the specific process for e-way bill rectification and applicable business compliances. This ensures compliance in the Indian finance ecosystem while helping you with vendor payment, vendor management and vendor delight.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.